If you believe everything you read, you’ve probably already been convinced that millennials — the largest generation in American history — only invest in Snapchat, Bitcoin, and Ethereum. Maybe some Ripple, too.

But if that’s what you think, you couldn’t be more wrong. Of course, Snap’s IPO and the meteoric rise of cryptocurrencies have snagged all the headlines.

Snap was the first major technology IPO in a while. And after seeing how well Facebook stock eventually performed, there was a ton of anticipation. Then Snap didn’t deliver. And everyone was ready to give their opinions why.

And how could you possible ignore the 2,000% run Bitcoin went on last year? Or the 6,000% run we saw from Ethereum? You just can’t.

With headline-grabbing investments like that, it’s no surprise you haven’t heard about all the other places this generation is putting its money to work…

Move Over, Ma and Pa

For the last 30 or so years, baby boomers have pretty much controlled the stock market. They were the biggest generation in American history. They got to ride the biggest wave of economic growth the U.S. has ever seen.

They entered the workforce while the rest of the world was still recovering from the devastation of WWII and at a time when American business had a stranglehold on the global economy.

They inherited more money than any generation before them. And they invested and worked hard to generate more wealth than any other generation had accumulated.

They put that money to work with companies that promised to grow their investment and put their needs as shareholders above all others.

And they did pretty well. Now, the baby boomers are getting ready to pass more money to their children than we’ve ever seen transferred between generations. I’m talking about more than $30 trillion over the next three decades.

To put that in perspective, we’re talking about nearly as much money as the GDP of the U.S. and China combined! That’s a lot of cheddar.

It’s their children, the millennials, who are going to inherit that fortune. And those children, just like their parents before them, are going to have extremely different ideas about how to spend and invest that cash…

Impassioned Investing

You see, millennials have different values and expectations than their parents. They view the world differently. They have different priorities. And they’re already showing them in how they’re starting to invest.

With every new generation to come into power, the world changes drastically. Up until the 19th century, animal torture was considered a form of amusement. Just think about it. One of our most honored inventors, Thomas Edison, used to electrocute animals to the thrill of crowds in order to paint his competitor’s alternating current as unsafe. A public execution was equivalent to a modern-day ice cream social.

But now, that kind of public display is considered appalling.

People changed their values and priorities. They were able to live comfortably. They didn’t have to worry about where their next meal would come from. And they now had the time and luxury of worrying about how others — even other species — were treated.

More recently, the baby boomer generation led the fight for racial and gender equality. When they were kids, that seemed like a far-fetched idea. But as they matured and took their place in business, politics, and society, their values and priorities became those of the mainstream. And change happened.

This generation will be no different. And thanks to the incredibly high standard of living these children have always enjoyed, they’re even more passionate about righting social wrongs than their parents.

They have less tolerance for deception, dishonestly, exploitation, and opaqueness than their parents did.

That means their investments are shifting toward companies that do two very important things: provide transparency into their operations and business segments, and take care of all stakeholders involved in their business, from shareholders all the way to employees and everyone in between.

And millennials are already starting to put their money where their emotions are.

Where Do You Shop?

A great example of a company that focuses on transparency and taking care of all stakeholders outperforming its less socially responsible peers is Costco.

Over the past five years, Costco’s total return — share price appreciation plus dividend payments — is up over 110%. Over the same time, its two biggest competitors, Walmart and Target, are up about 40% each.

You may remember reading or hearing about employees at both Walmart and Target demanding better pay and benefits in the recent past. But do you remember the stories about Costco’s employees?

That’s right, you don’t. There weren’t any. Because Costco isn’t just focused on increasing shareholder value. It’s focused on boosting employee satisfaction, too.

You may not know this, but at Costco, the average employee makes over $20 an hour. Compare that to around $13 an hour at Walmart and around the same at Target.

That may sound expensive and like a bad deal for shareholders. But Costco’s hourly employees generate nearly $22,000 per year in operating profit. At Sam’s Club, a division of Walmart that operates as a wholesaler, those same employees only bring in about $11,000 each year.

That’s nearly double the sales per employee compared to wages about 50% higher. Sounds like a pretty good trade-off to me.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Retirement Reboot: 5 Quick Fixes for Your 401(k) Plan.”

It contains full details on how you can deploy five “quick fixes” for your wheezing 401(k) plan.

And millennials are seeing things like this. They’re looking for companies like Costco that treat employees with dignity. They want companies that maximize shareholder value. But they don’t want ones that do it at the expense of others.

Millennials are investing in companies that take care of their employees, take care of suppliers and customers, and make a positive impact on their communities and the environment. And they still want companies that increase value for shareholders, too.

As these investments continue to build, it’s going to cause a shift in the world of finance and investing. No longer will revenues and earnings be the only drivers of stock profits. How socially responsible a business is will start to become more and more important.

Businesses that take care of all stakeholders in their process will become the blue chip investments of the next three decades. And everyone, including shareholders, will benefit.

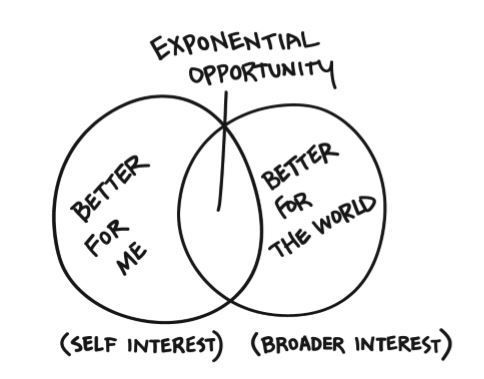

It’s a pretty simple equation. Find out what’s good for me. Find out what’s good for the world. See where they intersect. Attack the exponential opportunity the overlap creates.

Or, as Astro Teller, a former Google employee, put it, “Purpose is the point. Profit is the result.”

A Millennial Marketplace

Like it or not, millennials are going to control the stock market for the next 30 to 40 years. And the companies they support will be the ones delivering 20% to 30% annual growth — or returns 10,000% greater than the broader market.

If you want to take advantage of this shift that’s already starting, you need to make your plan now and start acting on that strategy before these companies really take off.

And that’s exactly what my colleague Briton Ryle and I have been doing with our long-term income investing newsletter, The Wealth Advisory, for the past few years.

We’ve already had great success from these millennial-centric stocks…

We just closed out a position in natural pet food maker Blue Buffalo Pet Products after watching it run up over 85% in just the last seven months.

We’re sitting on solid gains in the solar industry, too. Our investment in the best solar operation out there just ran up nearly 175% since last March.

We’re invested in a restaurant chain that’s already wildly popular among millennials. It rallied over 40% last November alone.

Our investment in the tiny company that Google, Facebook, and Uber can’t live without just skyrocketed. It’s up 38% just this year!

We’re also the proud owners of the top airline choice for America’s biggest generation. And we watched it shoot up about 23% between the start of last November and Christmas.

Or take our beauty company investment as another example. Granted, it was a poorly timed entry, and we’re looking at a loss. But as a long-term investment, it’s got the right stuff to become one of our best stocks ever.

This company was founded with the goal of providing high-quality beauty products at rock-bottom prices. It started off with a line of makeup products that cost $1 each. It’s since expanded into other price points but has kept the overall cost extremely low.

Millennials love this. They get top-notch stuff for brand-x prices. Champagne for the price of pruno.

And millennials love how the company interacts with its community and the environment, too. None of its products are tested on animals. They’re all vegan-friendly (no animal products) and they’re all cruelty-free (no animals were harmed during the making of this lipstick).

Right now, this beauty supplier is a tiny company. But it’s growing super-fast. It’s got deals with Target, Walmart, Walgreens, and Ulta to display and sell its products in their stores and online. Its shelf space is growing exponentially across those retailers, too.

Over the next few decades, we expect to see the company transform into one of the biggest beauty brands on the planet. And our investors got in at the absolute ground floor.

But even with all those whopping successes, we’re far from done. And if you’d like to ride the wave of change this new generation is bringing to the stock market, I highly recommend you join my readers at The Wealth Advisory.

We’ve got a track record that’s beat the market every year since 2008. At my last check, we’re beating the market by about 600% over the course of the service.

And thanks to our foresight and time-tested strategy, we’ll be growing those gains by leaps and bounds in the years to come.

So, don’t delay. Click here to learn about some of our best recent investments and get on board.

The market waits for no one. And you don’t want to miss the biggest, most explosive gains Wall Street has ever seen.

Take a few minutes out of your day to view this presentation Brit and I put together. Or read the written report here.

However you get the information, do it quickly, before the “Millennial Market” moves on.

To investing with integrity (and millennials),

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube